Ever wonder how the cycle works? Harvard Business Review has this great piece and flow chart.

In January, 2015 University of California made some ripples in the Venture Capitalist pond when they announced their decision to toss out their long-standing notions that the university would not get involved in outside ventures and replace it with a new ruling stating that they would have a $250 million fund for new ventures that emerge out of UC. It was a well calculated move, and not one that was entirely unexpected considering how many research facilities and incubators the university network already has. Frankly, while some considered it a bold move, it was a lucrative move as a lot of new businesses are generated by UC graduates.

From a business standpoint on the university’s perspective, this couldn’t have been a better move. Most universities have a wide range of revenues, from reality to venture capitalism to straight up investment funds. But here is where my awe of the move ends. Universities have their fingers in a lot of pies. They have a lot of money coming in from those other revenues, and they generate much from the IP licenses built off students and professors. I realised this when I read the fine print upon entering Purdue that declared that anything I made at Purdue, or for 7 years after my graduation, would be subject to inspection by Purdue. If they decided they wanted to extend their business to mine and take control, I would have very little choice in the matter.

I’d prefer the open negotiations of a formal VC than a surreptitious take-over any day.

But, still, my heart and instinct lies with the individuals. This could be because I don’t know much about the world of investing — except that someone else would make money off my hard work and ideas in exchange for the capital to make it happen. Or it could be that I believe that 90% the money should stay with the person that poured their life into it. Yes, I’m aware that most of the time the person leaves the company they founded with a tidy sum of cash, but it’s not nearly as much as those that invested in the idea. And that’s where my instinct takes issue with the fact. The investors gambled money, and when they win, they get a lot more than those that busted their ass to win it for them.

But, in the end, what really gets me about the university case is the iffy factor of intellectual property. Again, if it’s the student that generates the idea, then the professor and the group that make it come to life, the intellectual property should go to the student, professor, and working group. In all cases this is not true. Here’s a quip from K. Lance Anderson on the very topic as it appears in the National Law Review:

Technology commercialization out of universities is nothing new, but there is often an argument surrounding the level of involvement universities should have. Issues include the nature of faculty member ownership or control of the intellectual property (IP) rights they develop, or whether having a stake in the commercial interest of a technology affects research integrity. Universities approach these issues differently. Some are conservative, while others are pressing forward with new models for others to emulate. As systems consider investment scenarios such as UC Ventures, additional risks emerge, including whether a university system can both support its mission of furthering its research efforts and still maintain a sound investment strategy.

Clearly, being careful and smart before desperate is key.

It’s everyone’s prerogative how they gain the finances to run their business. Some bootstrap, others seek out investments. There’s nothing wrong with either option as long as you are smart about it. But know that if you do, the VC, investors, and others have a say in the way things are run and may even have part of the licensing and rights to make their gamble seem more worth it. But you gamble, too, whether you are seeking investments or not since it’s your ideas. Don’t forget to be just as careful of a gambler.

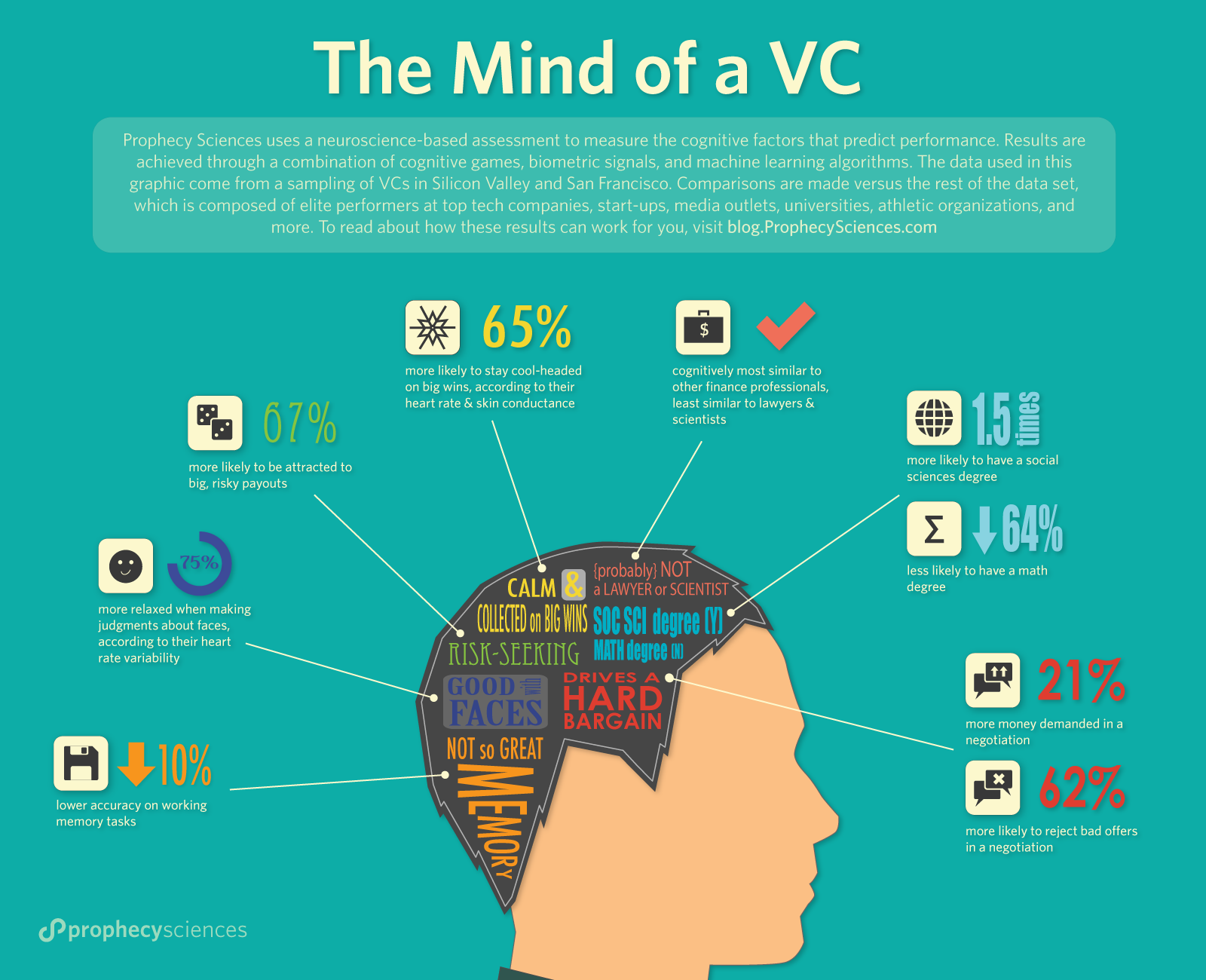

An interesting dissection of a potential mind of a VC. Would you trust this person to have a say in your company? (Found @ prophecy sciences.)

Your turn:

Are you thinking about asking for money as an investment? If so, what brings you to this point? What are your thoughts?